12th Oct,2022

About Sterlite Power

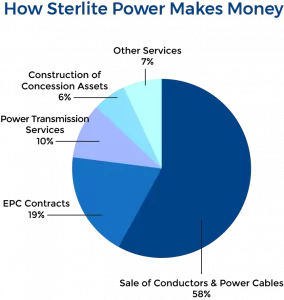

Sterlite Power develops integrated power transmission infrastructure and provides solution services through two business units: Global Infrastructure and Solutions.

Its solutions business unit consists of two sub-units. Its products sub-unit manufactures and supplies a wide range of products including high-performance power conductors, optical ground wire, and extra-high voltage cables. Its Master System Integration sub-unit provides bespoke solutions for the upgrade, uprate, and fiberization of existing transmission infrastructure projects. Besides, the company has another sub-unit that leverages existing power utility infrastructure for telecommunications purposes by building optical fiber infrastructure on top of existing utility networks.

Its Global Infrastructure business unit bids for, designs, constructs, owns, and operates power transmission assets.

Sterlite Power claims to be the largest private player in terms of project portfolio under the inter-state Tariff Based Competitive Bidding (TBCB) route, with a market share of 26% of transmission projects awarded through the TBCB route.

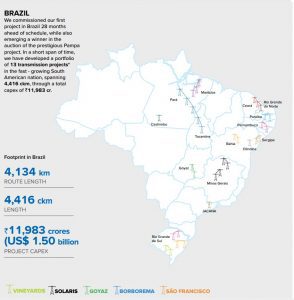

Further, according to data from the Brazilian Electricity Regulatory Authority (ANEEL), the company has a 13% market share of the transmission projects auctioned by ANEEL.

Current Assets

As per its IPO prospectus, it has 11 projects in various stages of construction and development (five in India and six in Brazil). Besides, it has 25 current and sold projects covering approximately 13,700 circuit km of transmission lines.

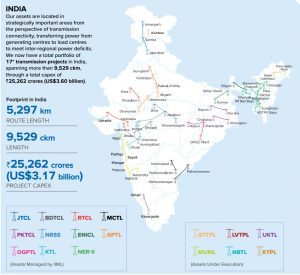

Caption: Its projects in India Source: Annual report

Its 10 completed projects and five ongoing projects in India span 9,246 km with a total capital expenditure of Rs 24,486 crore ($3.34 billion). Further, it’s four sold projects and six ongoing projects in Brazil span 4,416 km with a total capital expenditure of Rs 10,038.80 crore ($1.37 billion).

Its projects are in Brazil Source: Annual report

Business Outlook

The demand for electricity in densely-populated Indian cities is expected to continue to rise as a result of end-use electrification. CRISIL Research notes that the pace of awarding projects under the TBCB route has increased over the past few years. Between FY17-20, projects worth Rs 31,200 crore were awarded by central bid process coordinators in India. Further, different state transmission agencies have initiated bid processes through the competitive route.

Besides, CRISIL Research expects an addition of approximately 15-17 GW in wind capacity in India, entailing an investment of approximately Rs 1 lakh crore over FY 21-25. Further, in the solar segment, CRISIL Research expects the capacity addition to be much higher, at approximately 55-57 GW in the same period. India also has a target of setting up 450 GW of renewable energy by 2030.

Sterlite Power believes it is well-positioned to benefit from this increased deployment of renewable energy going forward.

Past performance

What makes the company attractive is its enviable track record:

– It has completed the construction and development of 10 transmission projects in India and one transmission project in Brazil.

– Delivered projects that are located in areas that are challenging.

– On or before time: It completed the first project in Brazil 28 months ahead of schedule.

Financial performance

The company’s recent financial performance has been a bit inconsistent affected by the pandemic. Its revenue from operations decreased at a rate of 16% during FY19-21 even though its total revenue increased at the rate of 2.24% CAGR. The company said its RoCE was 1.97%, 40.22%, and 36.68% during FY19, FY20, and FY21, respectively.In the meantime, the company has been able to cut down debt by more than half. It had a borrowing of Rs 2,781 crore as of FY21 compared to Rs 6,292 crore as of FY19. In FY21, the company’s cash flow from operations turned positive from negative a year earlier. It stood at Rs 553 crore.

IPO details

The company plans to raise Rs 1,250 crore from its IPO, through a fresh issue of equity shares of a face value of Rs 2 each. The company said it will use the proceeds from the issue for the repayment of the debt of the firm and its arm Khargone Transmission Ltd (KTL) and for general corporate purposes.

Valuations & Risks

The company has 6,11,81,902 outstanding shares. In the unlisted market, its share trades at Rs 800-900, valuing it at Rs 4,894-5,506 crore. At this price, the price-to-earnings PE ratio, taking into account FY21 EPS, stands at the 6.33 level. In comparison, Power Grid trades 8.6 times and Adani Transmission 276 times. This puts Sterlite Power in an attractive position.

Key risks to the investment could be its inconsistent performance, low margins on projects, debts, inability to win orders, cost overruns or delays in ongoing projects, and high competition. (Click here to know the latest share price of Sterlite Power unlisted shares)

Tell us in the comments section below whether you would like to invest in Sterlite Power Transmission Ltd’s unlisted shares.

Read Our Other Blogs:

Investing In This Beer Company Won’t Give You A Hangover

4 Tips for Unlisted Shares Investors to AVOID Another Paytm !!!